unfiled tax returns 10 years

If you are entitled to a tax refund you must file your unfiled tax returns. You could lose your chance to claim your tax refund or end up owing the IRS.

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Resolve Years of Unfiled Tax Returns Once you have missed filing a tax return it is easy to become nervous about the consequences and neglect to submit a return in future years as.

. After that the debt is wiped clean from its books and the IRS. If you dont file your return within three years of the due. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

Tax returns for prior years will have a penalty of 25 of the taxes due just for failure to file. When you file tax returns late youll always have penalties assessed against you. If you have several past-due returns to file the IRS normally requires that you file returns for the current year and past six years.

The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. If you dont file you cant get your tax refund. You can possibly face imprisonment for a length of time proportional to each year of the unfiled tax return.

However once the tax has been assessed the IRS only has 10 years to collect. Every year taxpayers fail to file and let the IRS hold their money interest-free. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Does IRS forgive tax debt after 10 years. If you havent filed a tax return for several years it could lead to some severe consequences and financial losses. The clock starts ticking when you file a return or the IRS assesses a tax against you.

However in practice the IRS rarely goes past the past six years for non-filing enforcement. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. While the IRS does not put a bulk of taxpayers in jail or monetary fines 25000 for.

Ad file unfiled returns with max deductions while reducing potential penalties interest. Many are worried about what the statute of limitations is on unfiled tax returns. You may be eligible to receive a refund for the last 3 years even if you have unfiled tax returns.

And you will receive. After the expiration of the three-year period the refund. But your specific facts and IRS rules will determine how far.

10 Years of Unfiled Tax Returns Client informed DeWitt Law that. They wonder if they should file if. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further enforce the law.

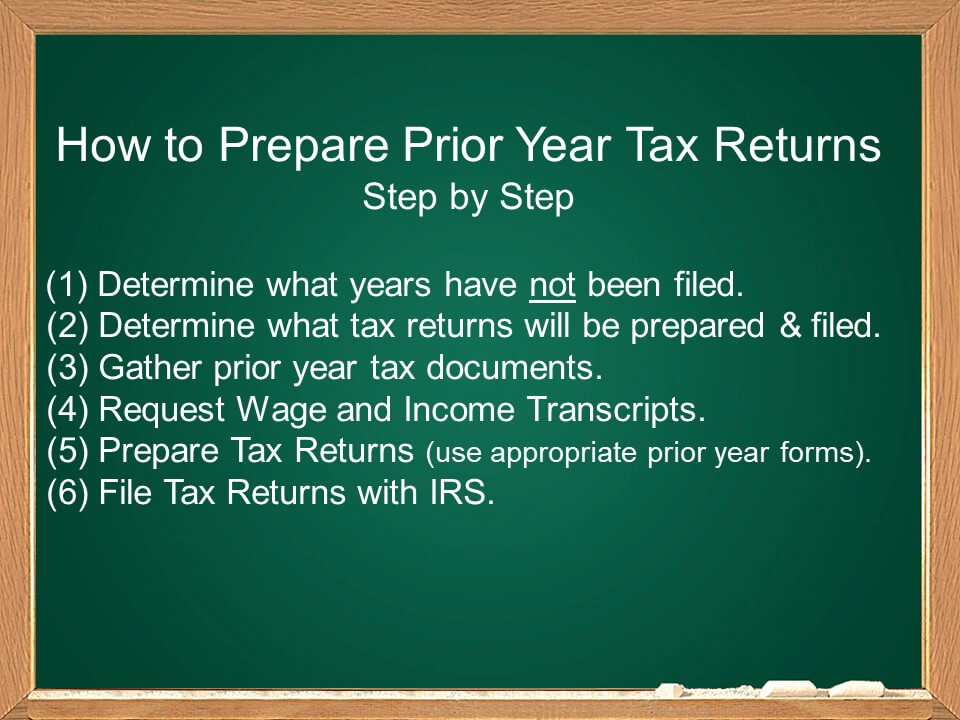

DeWitt Law prepared and filed with the IRS all missing tax returns. Clients tax liability was reduced by over 100000. Many have not filed tax returns for 10 years or even 15 years or maybe never.

In most cases the IRS requires you to go back and file your. What Should I Do If I. If you havent filed taxes for several years it could lead to some severe consequences.

How Far Back Can The Irs Go For Unfiled Taxes Lendio

Irs Stops Issuing These 10 Taxpayer Letters Temporarily See If You Re Affected The Us Sun

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

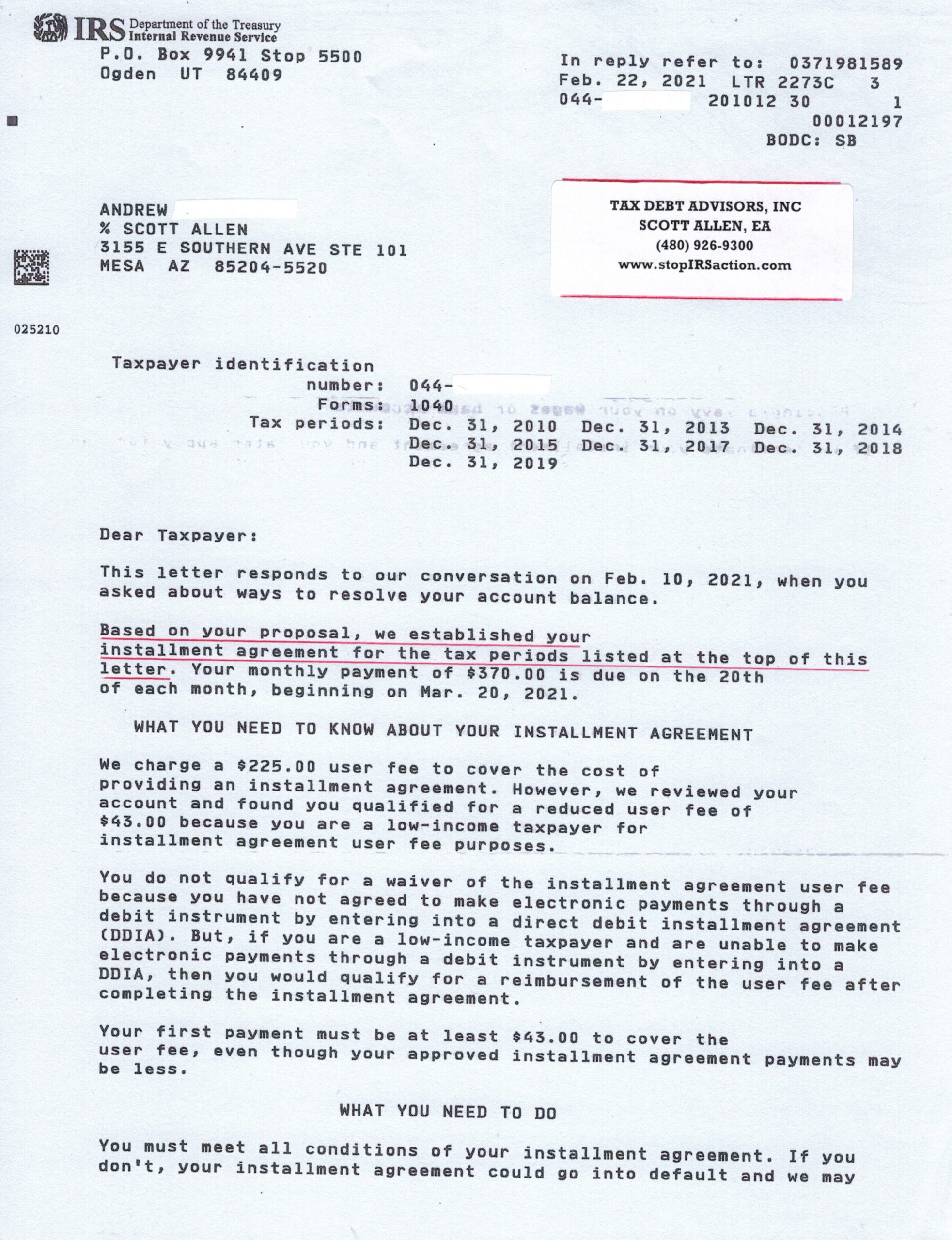

We Are Mesa Arizona S Top Irs Problem Solvers For Unfiled Tax Returns Tax Debt Advisors

Unfiled Taxes We File Your Delinquent Missing Back Taxes

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Notice Cp515 Tax Return Not Filed H R Block

Do This If You Haven T Filed Taxes In 10 Years Bench Accounting

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Astonishingly An Irs Non Filer Has 10 Of Unfiled Tax Returns

Scott Allen E A If You Need To File Back Tax Returns In Chandler Az Tax Debt Advisors

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Taxes Failure To File Income Tax Verni Tax Law

Why Would The Irs Reject A Tax Return Tenenbaum Law P C

Unfiled Tax Return Information H R Block